Indicators on Atlanta Hard Money Lenders You Should Know

Wiki Article

Getting The Atlanta Hard Money Lenders To Work

Table of ContentsAtlanta Hard Money Lenders for DummiesThe Ultimate Guide To Atlanta Hard Money LendersAtlanta Hard Money Lenders - TruthsRumored Buzz on Atlanta Hard Money LendersWhat Does Atlanta Hard Money Lenders Do?Atlanta Hard Money Lenders Can Be Fun For Anyone

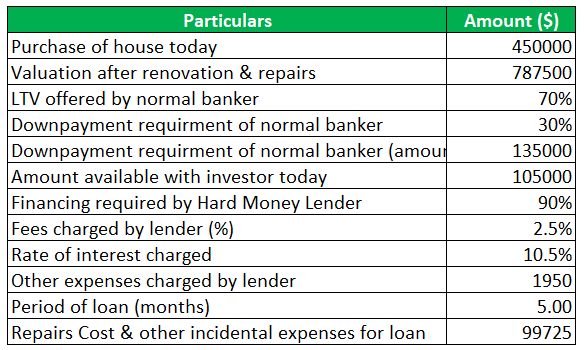

In numerous instances the authorization for the difficult money car loan can take area in simply someday. The hard cash lending institution is mosting likely to take into consideration the residential or commercial property, the amount of down settlement or equity the customer will have in the building, the consumer's experience (if appropriate), the departure approach for the residential property as well as ensure the borrower has some cash books in order to make the month-to-month car loan payments.Investor that haven't formerly made use of tough cash will be surprised at just how quickly tough money financings are moneyed contrasted to financial institutions. Contrast that with 30+ days it takes for a bank to fund. This speedy funding has actually saved numerous investor that have remained in escrow only to have their original lending institution draw out or simply not deliver.

Their list of demands boosts every year as well as much of them appear approximate. Financial institutions likewise have a list of problems that will certainly increase a warning and avoid them from even thinking about lending to a consumer such as current repossessions, short sales, financing adjustments, as well as personal bankruptcies. Bad credit history is an additional aspect that will certainly prevent a financial institution from providing to a consumer.

The Greatest Guide To Atlanta Hard Money Lenders

Luckily for genuine estate financiers who may presently have several of these issues on their document, difficult money loan providers are still able to provide to them. The tough money loan providers can lend to debtors with problems as long as the customer has sufficient deposit or equity (at least 25-30%) in the residential property.When it comes to a potential debtor that wants to buy a primary residence with an owner-occupied difficult money finance via a personal home mortgage lender, the debtor can at first purchase a property with difficult money and after that work to fix any concerns or wait the necessary amount of time to get rid of the concerns.

Financial institutions are also unwilling to give home mortgage to customers that are freelance or presently do not have the needed 2 years of work background at their existing position. The borrowers might be an excellent prospect for the financing in every other aspect, however these approximate demands stop financial institutions from extending financing to the customers.

How Atlanta Hard Money Lenders can Save You Time, Stress, and Money.

When it comes to the consumer without enough employment history, they would certainly be able to re-finance out of the difficult money finance as well as into a lower price standard financing once they obtained the needed 2 years at their current position. Hard cash lenders give lots of financings that conventional loan providers such as financial institutions have no interest in financing.

:max_bytes(150000):strip_icc()/hard-money-basics-315413_Final-cdfb8155170c4becb112da91bd673fe8-0472b1f57ff94abebddef246c221a65f.jpg)

These jobs entail an investor buying a residential or commercial property with a short-term financing to make sure that the investor can promptly make the required repair work as well as updates and after that market the residential property. atlanta hard money lenders. The actual estate financier only requires a 12 month car loan. Banks desire to lend money for the long-term and also enjoy to make a percentage of passion over an extended period of time.

The issues can be related to structure, electrical or plumbing and also can trigger the financial institution to take into consideration the property uninhabitable as well as unable to be funded. and also are not able to think about a lending situation that is outside of their stringent lending standards. A tough money lender would have the ability to give a consumer with a loan to buy a building that has problems stopping it from getting approved for a traditional bank lending.

Some Known Incorrect Statements About Atlanta Hard Money Lenders

Difficult money loan providers also charge a car loan origination charge which are called factors, a portion of the funding amount. atlanta hard money lenders. Factors generally vary from 2-4 although there are lending institutions that will bill much higher factors for certain circumstances. Certain locations of the country have several contending difficult money lenders while various other locations have few.

In large cities there are normally numerous even more difficult cash loan providers ready to offer than in more remote backwoods. Debtors see page can benefit greatly from inspecting rates at a couple of various lending institutions before committing to a tough money loan provider. While not all hard money lenders supply 2nd home loans or depend on deeds on homes, the ones that do charge a greater rates of interest on 2nds than on 1sts.

Atlanta Hard Money Lenders Can Be Fun For Anyone

This raised rate of interest shows the boosted risk for the loan provider remaining in 2nd setting instead of 1st. If the borrower goes into default, the 1st lien holder can seize on the residential property and also eliminate the 2nd lien holder's rate of interest in the building. Longer regards to 3-5 years are readily available yet that is usually the top restriction for finance term size.If interest prices drop, the consumer has the alternative of re-financing to the reduced present rates. If the rates of interest increase, the borrower has the ability to maintain their reduced rate of interest car loan as well as lender is compelled to wait until the loan comes to be due. While the loan provider is waiting for the car loan to come to be due, their financial investment in the trust fund action is generating less than what they might Clicking Here get for a new count on deed investment at present prices.

Excitement About Atlanta Hard Money Lenders

This is a worst instance scenario for the hard cash lender. In a comparable scenario where the customer puts in a 30% down settlement (as opposed to just 5%), a 10% decline in the value of the residential property still gives the debtor lots of motivation to stick with the building and also job to safeguard their equity.Report this wiki page